Nigeria’s central bank digital currency (CBDC), the eNaira, launched today following an announcement by President Muhammadu Buhari.

Buhairi said the digital currency and the blockchain technology it uses can foster economic growth and increase the GDP of Africa's biggest economy by $29 billion over the next 10 years.

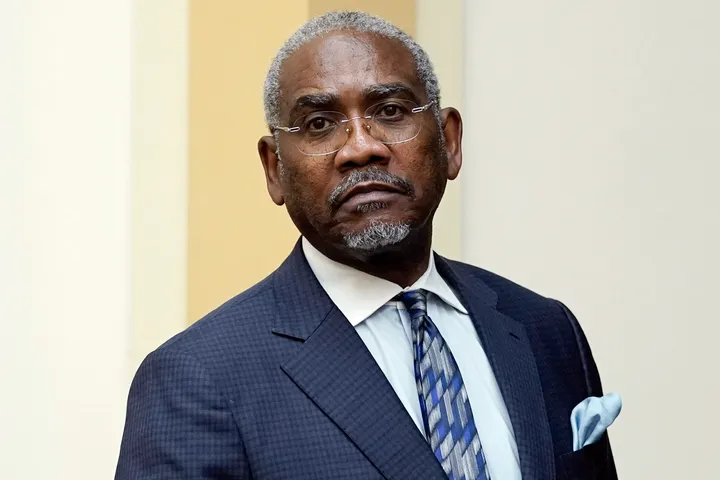

Nigeria’s Central Bank (CBN) Governor Godwin Emefiele said that around 500 million eNaira (1.21 million) have already been minted in lieu of the digital currency going live.

In a press release on Saturday, the CBN said the eNaira’s launch “marks a major step forward in the evolution of money and the CBN is committed to ensuring that the eNaira, like the physical Naira, is accessible to everyone.”

CBDCs are rapidly gaining popularity worldwide, and Nigeria is the first African country to officially launch a sovereign-backed digital currency pilot.

With a population of 211 million, Nigeria’s CBDC trial now becomes the second largest behind China’s digital yuan. On top of that, over 62 percent of Nigerians are aged 24 or under, making the eNaira available to a largely digitally native population.

Development of the eNaira was carried out by fintech company Bitt, whose Digital Currency Management System is also behind the East Caribbean Central Bank’s digital currency DCash.

Possible impacts of the eNaira

Pegged to fiat currencies and backed by a country’s monetary reserves, CBDCs are emerging as the path for governments to co-opt the momentum that has been building around digital assets, principally as an answer to the popularity of cryptocurrencies like Bitcoin, which are decentralised and outside the remit of regulatory oversight.

A similar story has played out in Nigeria, where the government and central bank struggled with the rise of cryptocurrency in the country.

Nigeria has been one of the leading markets for digital currencies, ranking sixth in terms of cryptocurrency adoption in the world. It is the largest market for global crypto trading platform Paxful, which has 1.5 million Nigerian users out of its 7 million users worldwide.

Aside from wealth creation, the popularity of Bitcoin in Nigeria was driven as a hedge against the naira’s inflation. The currency has been devalued twice and is worth 12.5 percent less since the onset of the pandemic.

In an effort to curb the growing popularity of crypto, in February the CBN ordered local banking institutions to stop dealing in cryptocurrencies and stop facilitating payments for crypto exchanges. Four months later, plans were announced to introduce the eNaira.

Among the CBN’s goals is to digitise payments and increase financial inclusion, and a CBDC can offer citizens greater access to financial services for the underbanked or unbanked.

“As Nigeria is still considered one of the most ‘unbanked’ countries in the world, decentralized identity systems and CBDCs will provide the population with a way to prove their identity and get access to banking services directly from their smartphone,” Ben Constanty, co-founder of Smartlink, told CoinDesk. “It also means that every transaction will go through that system in order to buy and sell things.”

Those sending remittances also stand to benefit. Given foreign exchange restrictions and high transaction fees linked to sending money in and out of the country, Nigerians have previously been using Bitcoin as a faster and cheaper alternative to make domestic and international transactions.

Using the blockchain ledger, the eNaira will be able to eliminate the need for third parties and contribute to efficient and low-cost transactions, as consumers gain access to low-risk and reliable payment options.

Additionally, enhanced oversight of funds and payments provides a level of transparency that can serve to strengthen public confidence and allow financial authorities to tackle economic crime and fraud.

However, critics of CBDCs fear they will allow central banks to accrue greater control, serving as a tool for regulators to monitor private citizens’ financial footprints.

“As central banks globally jump on the digital currencies wagon, the space is likely to witness more regulations, limitations and even censorship, as these will be controlled networks,” says Constanty.

The Nigerian banking sector is also likely to face a new challenge when dealing with digital assets. With the CBN offering a virtual wallet where everyone can store their money, does it make the need for banking intermediaries redundant?

Apart from Nigeria, the Bank of Ghana announced in June the pursuit of its own sovereign digital currency called the e-Cedi, while South Africa’s reserve bank launched a retail CBDC feasibility study in May.